Current Issues

Fighting Inflation:

Tax Cuts for Hardworking Ohioans

How Inflation Is Affecting Ohioans

Inflation is a major economic problem that is impacting families across Ohio. It is important to have fiscal policies in place that can help to lessen the burden of inflation on Ohioans. One way to lessen the burden of inflation is to cut taxes. When taxes are cut, people have more money in their pockets to spend, which can help to boost the economy. This can also help to offset the effects of inflation, as people will have more money to buy goods and services that have increased in price.

Historic Income Tax Cut

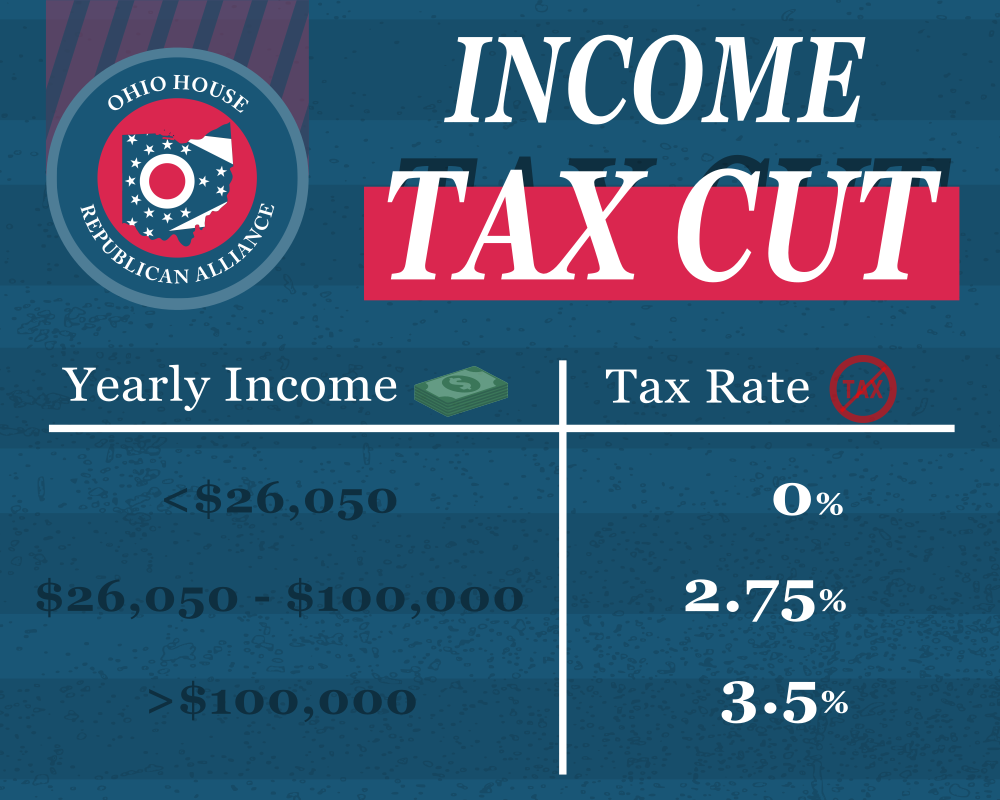

Ohio’s House Republicans delivered a historic income tax cut, combatting President Biden’s runaway inflation and saving Ohioans nearly $3 billion. Under this new system, Ohioans will have two income tax brackets:

- Those earning under $26,050 will pay 0%

- Those earning between $26,050 and $100,000 will pay 2.75%

- Those earning above $100,000 will have a flattened rate of 3.5%

By simplifying Ohio’s income tax, Ohioans will have more money in their pockets.

“We’ve lowered, flattened, and permanently cut income taxes, made historic investments in education funding and school choice, preparing our workforce, and protecting our most vulnerable citizens. This budget will have a lasting impact on Ohio for years to come.”

Jason Stephens

OHIO HOUSE SPEAKER

Ohio is open for business

House Republicans eliminated the burdensome Commercial Activities Tax (CAT) for 90% of businesses that pay it. Here are some specific examples of how limiting the CAT could benefit businesses in Ohio:

Business Growth Tax Cut

- A small business that sells widgets would save money on taxes, which it could use to invest in new equipment or marketing. This could help the business to grow and create jobs.

- A large company that is considering expanding its operations in Ohio would be more likely to do so if the CAT were lower. This would bring jobs and investment to the state.

Back-To-School Tax Holiday

- Extended the back-to-school summer sales tax holiday, providing a reprieve for Ohio’s parents sending their children back to school.

- By cutting taxes and reducing government spending, we can help to boost the economy and make it easier for Ohioans to afford the things they need.